|

|

|

|

October 2012 |

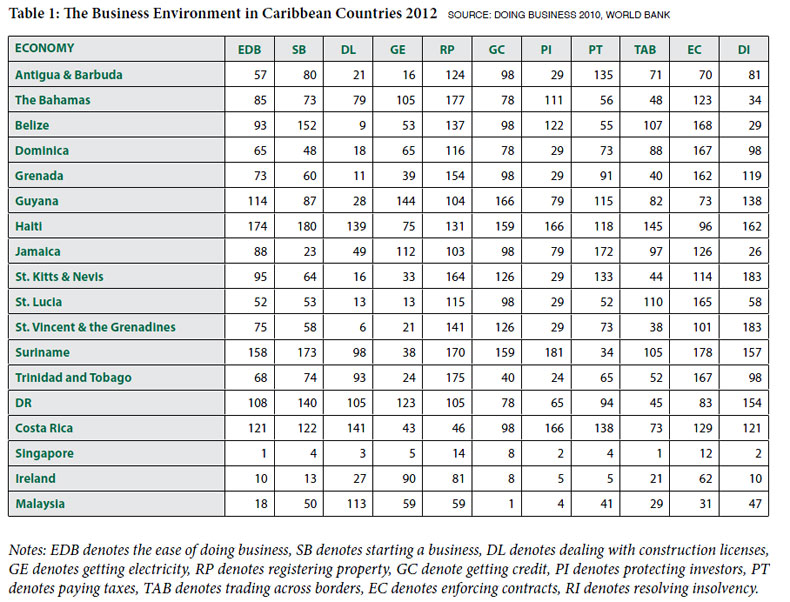

Some of the most important factors affecting the competitiveness of Caribbean businesses include relatively low productivity, especially that of labour; small market size; low investment in research and development for product innovation; a relatively underdeveloped institutional framework to support business development; strategic mistakes by major corporations and a sometimes convoluted business environment. Moreover, the international industrial and business standards driving firms’ ability to participate and compete in markets means that businesses now have to modernize and restructure their business processes and management systems. Using indicators from the World Bank’s Doing Business Report 2012, (which ranks 183 countries on a range of attributes important to successful business operations) the Region did not perform well relative to some of the more successful economies in terms of the general business environment (See Table 1).

This is not surprising given that businesses in the region have always complained about the bureaucratic process, the standards and rules they endure just to conduct business in national jurisdictions. You can imagine how much more complicated it gets trying to step across borders! The complaints are that these bureaucratic processes are unnecessarily complicated with parts of the process often controlled by a multiplicity of different, poorly staffed agencies. This results in a convoluted and lengthy process for business activities which require approvals or assistance from the State. Businesses also complain about a lack of transparency and inconsistency in the application of standards and rules. There have been some improvements recently in areas such as dealing with construction licences (DL) and protecting investors (PI) but the region continues to do poorly in terms of enforcing contracts (EC), dealing with insolvencies (DI), registering property (RP) and getting credit (GC). Very importantly, the region also generally did poorly in terms of trade across borders (TAB). This implies that the legal/administrative framework in the areas of contract enforcement, business closure, property registration and trade facilitation needs to be simplified. Often, even if the legal framework for these activities is clear and well developed, the problem lies in the fact that government agencies charged with administering these processes are poorly financed and staffed, which leads to the approval process being unnecessarily lengthy and costly. These indicators seem to corroborate the findings of a survey of very large firms by the CARICOM Secretariat in December 2009. The one exception in this regard was in the area of access to financing, which was not flagged as a binding constraint by the large firms surveyed. The development of a regional financial market based on large regional financial institutions, particularly from Trinidad and Tobago has made financing of large projects easier. The development of a nascent regional bond market has also helped in this regard. Nevertheless, small and medium enterprises, especially those engaged in non-traditional business activity, are still disadvantaged in this area and very likely contributed to the poor scores in the area of getting credit for many countries in Table 1. These large firms also identified bureaucratic hurdles and the variety of different national rules, regulations and standards they must deal with when conducting business across the region as a major constraint. Issues flagged as being important included transparency and predictability in the application of rules and standards. Other important constraints included the simplification and standardisation of customs procedures, speedier customs clearance and the standardisation of non-tariff standards such as labelling requirements and sanitary and phytosanitary standards. The firms surveyed also indicated that the harmonisation of legislation needed to be expedited in the areas of company laws, financial regulation, the licensing regime and intellectual property rights. Dave Seerattan is an economist attached to the Caribbean Centre for Money & Finance. The 5th Biennial International Business, Banking & Finance Conference (BBF5) will be held over the period May 1-3, 2013 at the St. Augustine campus of The UWI and at the Hyatt Regency Trinidad. It is being jointly hosted by the Department of Management Studies, the Caribbean Centre for Money & Finance and SALISES, and will feature discussions such as the above. |