SUNDAY 3RD APRIL, 2016 – UWI TODAY

21

Based on this analysis, to achieve inter-generational

equity, the resource rents generated fromexhaustible or non-

renewable resources must be re-invested in reproducible

capital.

But the authors then apply this reasoning (called the

Hartwick rule) seemingly to justify economic and social

outcomes in Tobago. In my view this is another case of

forced fit.

First of all, the transfers from the Central Government,

which comprise the bulk of the Tobago’s budgetary

resources, are treated just as commodity export revenues.

They are certainly not. Moreover from2005 to 2013, a period

in which there was a substantial increase in commodity

export earnings, there was no commensurate increase in

budgetary transfers to Tobago.

Secondly, the calculations use several proxies because

of the “unavailability of data.” The Central Statistical Office

has produced inflation data for Tobago for many years. Yet

the article uses the prices of agricultural commodities and

construction materials as a proxy for inflation in Tobago.

The Office of the Secretary of Finance produces annual GDP

data for Tobago so it is not entirely correct to say that these

data are unavailable. At any rate, it is not obvious that foreign

tourist arrivals are a good proxy for economic activity in

Tobago. There is a view that since the start-up of the new

inter-island ferry service in 2008, the increase in domestic

tourism may have more than compensated for the decline

in foreign tourists.

It is likely that ongoing oil and gas exploration off

the Tobago coast, if successful, could create pressures

associated with Dutch Disease. Thus the recommendations

for increased investment in human and physical capital are

in order.

I do not think it is realistic to expect the oil companies

to play a major role in the financing of these infrastructural

investments, as a demonstration of corporate social

responsible. (At least in this article the authors are somewhat

less sanguine about the possibility.) I would suggest that an

alternative approach, from a policy view-point, would be a

government levy on the extractive industries with the funds

earmarked for community development.

The last of the articles on the economy is authored by

three staff members of the World Bank and deals with our

pressing challenge of economic diversification. For those

who like to dabble in econometrics, the article contains

a very interesting survey of a number of studies on the

determinants of economic diversification in resource-

rich countries. Not surprisingly the results are sometimes

conflicting and counter-intuitive, underscoring the fact

that there is no one blueprint for diversification. Instead

diversification policies need to be tailored to the specific

circumstances of each country.

Applying their econometric model to the specific

case of Trinidad and Tobago, the authors conclude that

the main impediments to economic diversification are

the usual suspects: Dutch disease, largely brought on by

counter-cyclical fiscal policies; the unsatisfactory quality of

education; inadequate economic infrastructure; insufficient

innovation and technological readiness outside the energy

sector and a business climate still in need of improvement.

While the factors cited are indeed critically important,

the article fails to adequately consider the role of our

institutions in our still unsuccessful efforts at economic

diversification. Recent research has begun to analyze the

diversification challenge faced by resource-rich developing

countries not solely in terms of economic incentives but

through the lens of political economy.

Thus, AlanGelb fromtheCenter ofGlobal Development

puts the blame squarely on weak institutions and poor

governance. Gelb argues that “large natural resource rents

make young democracies malfunction and there is tendency

for these countries to lack accountability and to practice

patronage politics.” According to Gelb, these small countries

tend to become hostage to economic policies that are driven

by short horizon, patronage-driven electoral competition

and a non-transparent allocation of resource rents.

Some of that may be operating here in Trinidad and

Tobago, reflected in the disproportionate concentration

of government expenditure on subsidies, transfers and

make-work programmes, as against economic and social

infrastructure. Our economy has serious skills gaps,

particularly in the public sector, yet patronage politics tend

to keep many competent managers and professionals from

full participation, resulting in the under-utilization of scare

human resources.

BOOK REVIEW

This is a very informative and provocative article,

which perhaps does not go far enough. For economic

diversification, we certainly need to get the market

incentives right but we need to do more than that – we

need to work on our institutions. Improving our business

climate is central to building international competitiveness.

However, it is time that we accept that this requires not only

reducing red-tape and improving our work ethic; it also

means dealing with crime and corruption, which too, are

major blots on our investment climate.

“In the Fires of Hope” has certainly brought greater

clarity to some of the economic and political challenges

Trinidad and Tobago still faces 50 years after independence;

and that is an important service. The three articles on

the economy have all pointed to issues in the energy

sector which have impeded progress towards economic

diversification. The recent slump in oil and gas prices has

made economic diversification even more urgent but a

bankable diversification strategy is still not in the offing. I

have tried to point out areas where the economic analysis

and the policy prescriptions could be strengthened. Even

with these shortcomings, “In the Fires of Hope” is a

formidable undertaking and all those who made it possible

should be commended.

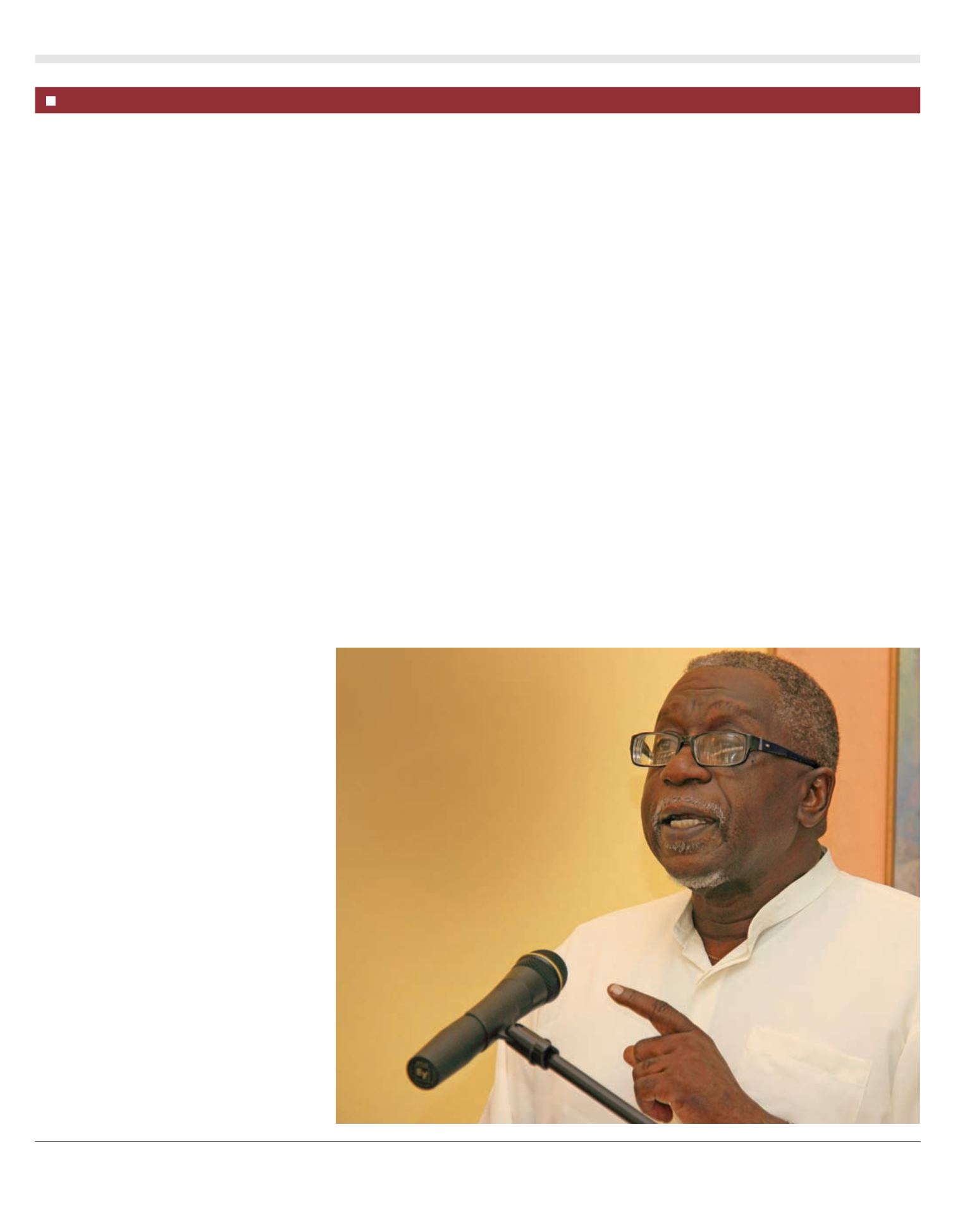

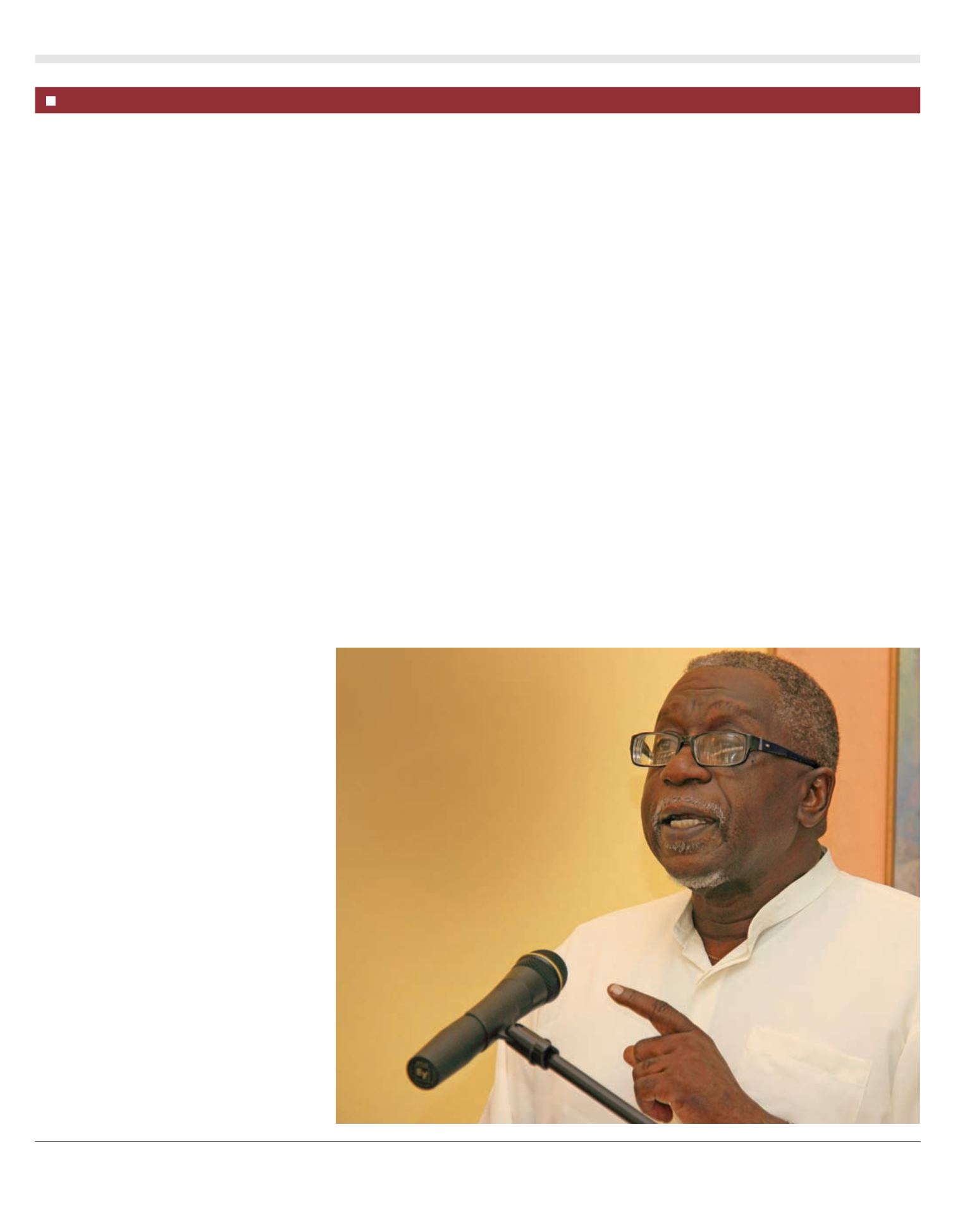

Mr. Ewart Williams, Chair of the Campus Council, was invited to critique the first of a two-volume series, dedicated to celebrate the 50

th

anniversary

of Trinidad and Tobago’s Independence, “The Fires of Hope” at its launch on March 2, 2106 at The UWI.

“For economic

diversification, we

certainly need to get the

market incentives right

but we need to do more

than that – we need to

work on our institutions.

Improving our business

climate is central to

building international

competitiveness.”

Mr. Ewart Williams,

an economist and

former head of the

Central Bank of

Trinidad and Tobago,

at the launch of

“The Fires of Hope”

at The UWI.

PHOTO: ANEEL KARIM

Our economy has serious skills gaps

,

particularly in the public sector, yet

patronage politics tend to keep many competent managers and professionals from

full participation,

resulting in the under-utilization of scare human resources.