|

December 2009

Issue Home >>

|

By Anna Walcott-Hardy

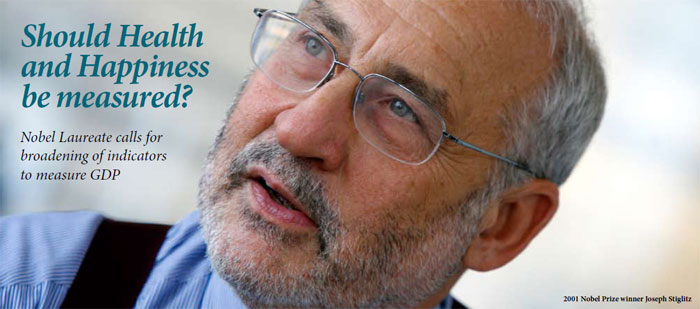

Almost two weeks before world leaders converged on Copenhagen for the Climate Change Summit, 2001 Nobel Prize winner Joseph Stiglitz, spoke of the importance of broadening the indicators used to measure the growth anddevelopment of a country.

Throughout the Distinguished Open Lecture held at The UWI St Augustine Campus in November, the Columbia University Professor underscored the need for more efficient, transparent indicators, including measures of environmental and resource depletion, to reflect the well-being of a society.

A self-described “theorist”, the former World Bank Senior Vice President, held the attention of the audience in the standing-room-only Daaga Auditorium for over an hour; without power point slides, charts, or even a video clip.

Focusing on ‘Economic Performance and Social Well-Being’, Stiglitz underscored the constraints of using traditional statistical tools that focus on an average, in terms of income and production, but do not reflect “typical experiences and what people care about.”

He argued that national leadership had a responsibility to identify the key indices of economic activity, in keeping with the overall concerns of the population. In resource-rich countries like the USA and Trinidad and Tobago, where the natural resources are being depleted, he stressed that there was a need for a more comprehensive assessment of development.

“The measure…becoming poorer, should reflect that resource depletion and environmental degradation…It’s very important that the stats that we gather reflect what people care about.”

He gave a particularly striking example of the Gold Mining Industry in Papua New Guinea, where industry development led to a spike in the GDP and profits for foreign investors but negatively affected the population, with the pollution of the environment, including rivers, and the loss of income for locals, with a heavy impact on the fishing industry.

“If you don’t have good stats, it’s like driving blind: you don’t know where you’re going…If your stats don’t provide an accurate description of what’s going on, you can make some bad decisions.”

In his relaxed, conversational style, he made the topic of economics and accounting, not only interesting, but relevant. From Keynes to Bernanke, Reaganomics to the global economic crisis, his witty anecdotes distilled hard core theories into real-world situations that connected with the audience.

It seems that his views had connected with French President Nicolas Sarkozy, who appointed Stiglitz to head a Commission on the Measurement of Economic Performance and Social Progress to look into the production of more relevant indicators of social progress. The Commission is chaired by Joseph Stiglitz and advised by Amartya Sen.

The Nobel Laureate may be lauded as being prophetic, for as far back as the 1990s, and even earlier, he predicted the rather rapid decline of the US economy. He reported that although many of the statistics may not have reflected this, more Americans were worse off in 2008 than in 2002—the rich were getting richer and the gap between middle and wealthy widening. Over time, accounting procedures were weakened, combined with poor risk management by financial institutions and more money being invested in a housing “bubble” than in healthcare, education and the environment.

In ‘Dealing with Debt: How to reform the Global Financial System’, an article published in the Harvard International Review (Volume 25, 2003) his call for reform was on target.

“Something is wrong with the global financial system. One might think the system would shift money from rich countries, where capital is in abundance, to those where it is scarce, while transferring risk from poor countries to rich ones, which are most able to bear it. A well-functioning global financial system would provide money to countries in their times of need, thereby contributing to global economic stability. Through an orderly bankruptcy procedure, a wellfunctioning global financial system would grant a fresh start to those who cannot meet their debt obligations, giving creditors an incentive to pursue good lending practices, while ensuring that borrowers able to repay loans do so. The current global financial system does none of these things.”

Having received his PhD from MIT in 1967 and having taught at MIT, Stanford, Yale and Oxford, then being awarded the Nobel for his work on the analyses of markets with asymmetric information, his understanding of the global markets is not surprising. For Stiglitz the question was not whether the crisis would occur, but when and where.

“Observers in the early 1990s, however, lauded the huge flows of private capital—at one point exceeding US$300 billion—from developed to developing countries, heralding a new era in which the private sector would supplant the need for public assistance. But this was a hollow boast. Even then, it was clear that most of the money went to a few countries, most notably China, and virtually none to the countries that needed it most, such as those in sub-Saharan Africa. Nor was the money spent in desperately needed sectors like healthcare, education, and the environment. Developing countries could attract firms to extract their natural wealth--provided they gave it away cheaply enough. There was far less success in attracting investments that would create new jobs. Worse still, much of the money was speculative—hot money—coming in while the going was good, but fleeing the moment matters looked less rosy.”

A storyteller at heart, during the UWI lecture, Stiglitz turned to a somewhat politically incorrect scenario to underscore the point of the limitations of GDP. Two scenarios: the first is the story of a couple that stays at home, cooks dinner using crops from their very own vegetable garden and enjoys a quiet evening; high contentment or happiness factor, but low GDP levels. The second scenario is of a professional who eats dinner at a fancy restaurant etc., goes in search of (ahem) entertainment, then returns to another venue to enjoy a few drinks, has a car accident while driving home and ends up in the hospital; high GDP, but surely a much lower happiness factor and definitely lower on the scale of social well-being.

Stiglitz, who was key in the development of the 1995 Report of the Intergovernmental Panel on Climate Change, cited the UNDP’s Human Development Index (HDI) as one alternative to the GDP. He pointed out, “If you care about education and health, then the GDP doesn’t accurately measure what you care about.”

However, the question many ask is: how do we measure our happiness? This Stiglitz touched on briefly during the dynamic open forum hosted by Dean of the Faculty of Social Sciences, Dr Hamid Ghany. But that’s another story.

|