SUNDAY 5 AUGUST, 2018 – UWI TODAY

13

CAMPUS NEWS

Regional Tobacco Tax Harmonization

A High-Level Knowledge Exchange Conference

on Regional Tobacco Tax

Harmonization in the Caribbean was organized by the World Bank Group’s

Tobacco Control Program, under the leadership of PatricioMarquez andThe UWI,

HEU, Centre for Health Economics, under the leadership of Prof Karl Theodore.

The purpose of the Conference was to discuss the way forward for tobacco

tax harmonization across the OECS region, based on the experiences and lessons

learned fromother customs unions across the world.The Conference was envisaged

to be the starting point of tobacco tax harmonization discussion in the region and

was born out of a recently drafted report on the state of excise taxes in the OECS

region.The Report was drafted by the HEU-UWI, in collaboration with theWorld

Bank Tobacco Team, and with data generated by the Statistical offices and Customs

and Excise Divisions of participating OECS member countries. Included in the

report were simulations on harmonization scenarios for 2019 to 2021.

The Conference was attended by representatives from;

• World Bank Group’s Tobacco Control Program;

• The UWI, St. Augustine Campus;

• Organization of Eastern Caribbean States (OECS) Secretariat;

• Ministry of Health and Ministry of Finance officials from the OECS and

Trinidad and Tobago;

• CARICOM (Caribbean Community);

• Pan American Health Organization/World Health Organization;

• European Union (EU);

• West African Economic and Monetary Union (WAEMU); and

• The Economics of Tobacco Control Project team, Cape Town University,

South Africa.

Among the subjects discussed:

Draft report on, Advancing Action on the Implementation of Tobacco tax

Harmonization in the OECS.

• Each country was invited to give their thoughts on the report, the applicability

of the findings in their respective contexts, and potential commitments to

harmonizing tobacco excise taxes.

• There was a general consensus that the harmonized rate should be set as a

minimum (price floor) where individual countries could exercise freedom

in setting a higher excise tax level based on country’s agenda.

• Participating countries indicated that there was strong political will for

strengthening tobacco taxation and an effort to harmonize tobacco taxation

would be timely, given that tobacco tax reformdiscussions have been on-going

in many countries.

• To achieve the health status goals, it was identified that the increase in taxation

translates into retail price increase i.e. cigarettes should become less affordable

over time to deter initiation and encourage cessation.

• It was also suggested that excise tax increases be publicized so that the public

could pre-emptively change its smoking behaviour.

Applicability and effect of the tax harmonization at the OECS regional level

• Currently tobacco control policies are determined at the national level with

different tax structures, levels of taxation, and processes for tax collection.

While there are currently five different types of taxes are applied on tobacco

products across the region, the proposal is to rationalise to three types of

taxes: Customs (CET), VAT and excise tax.

• The exact taxation rate that will fit all of the countries in the region will need

to be assessed.

• It was widely believed that simpler tax systems are better than more complex

taxes. A uniform specific tax that is adjusted regularly for inflation and income

growth is regarded as best practice.

Illicit tobacco trade in the Caribbean region

• While concerns were raised about the illicit trade in the region and the impact

on tax revenues, stronger port controls and legislation were identified as

measures to minimize such trade.

Availability of data and data monitoring in the region

• A lack of data hinders tobacco control policy andmonitoring. It was suggested

that a data repository for the region be created.

Earmarking excise tax revenues; tobacco tax revenues

• Some countries favoured earmarking revenues specifically for healthcare as

well as smoking cessation programmes.

The Conference was held on June 21and 22 at the HEU, Centre for Health Economics,

Sir George Alleyne Building, 25A Warner Street, St. Augustine.

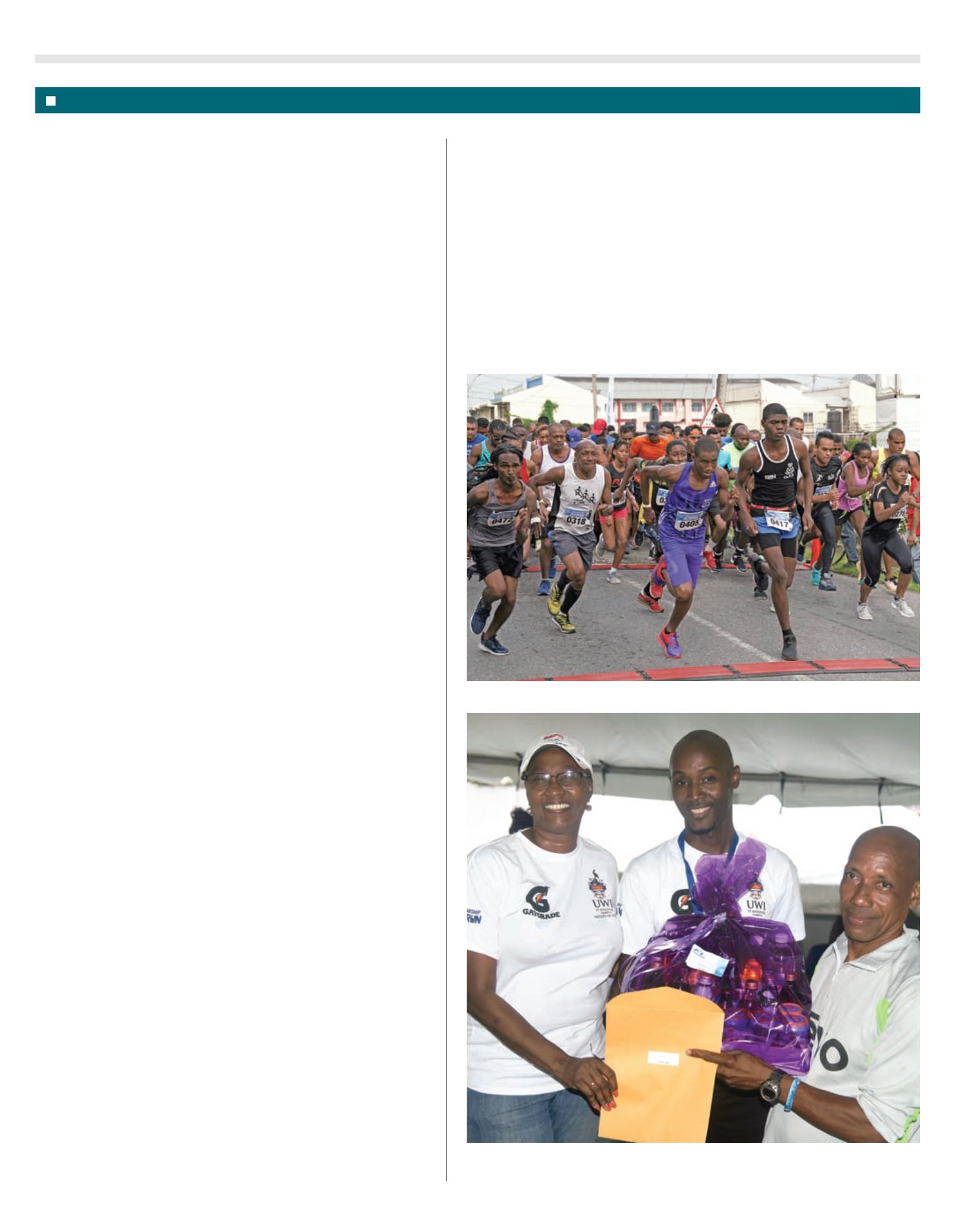

Ms. Grace Jackson, Director, UWI SPEC, with Mr. Connell Lord, Administrative Assistant (Accounts), Sports Fitness

and Athletic Development and Cantius Thomas, prize-winner.

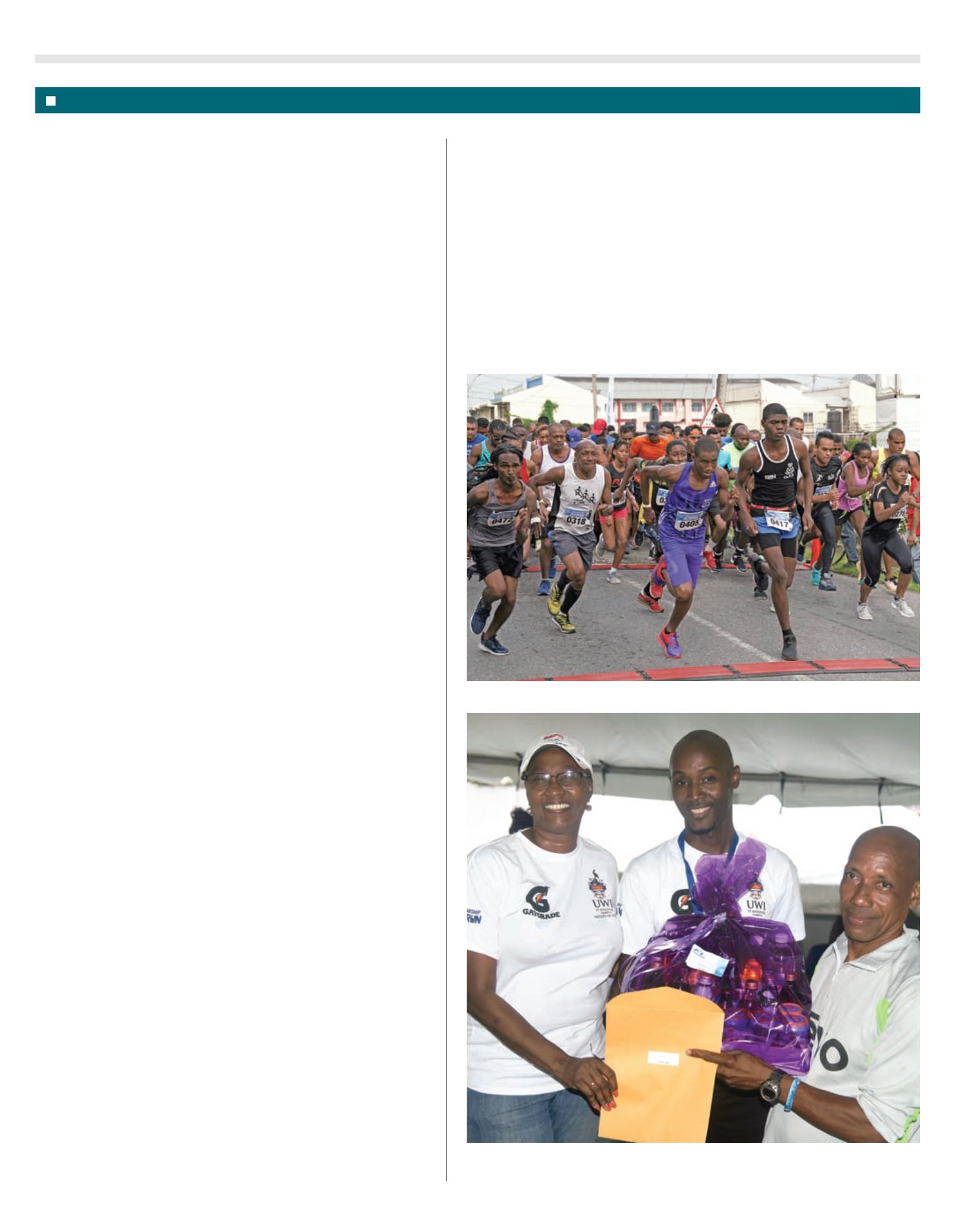

The UWI Scholarship 5K Fun Run

took place on Sunday June 24, from the

UWI Sport and Physical Education Center (SPEC) and it was well attended

by staff, students, alumni, and other friends of The UWI. This inaugural 5K

was held to raise funds for scholarships for student athletes.

Runners take off at the SPEC starting point.

UWI Scholarship

5KRUN