Fiscal Policy / Taxation / Sin Taxes

The HEU has collaborated with national, regional and international agencies to conduct research in various areas.

Featured Research

Tobacco Taxation in Trinidad and Tobago

Tobacco Taxation and Impact of Policy Reforms: Trinidad and Tobago

This research provided an assessment of the tobacco tax systems and fiscal structures in Trinidad and Tobago using data collected from over 100 retail establishments across Trinidad and Tobago. Data analysis included descriptive analyses and forecasting of key variables derived from the tobacco tax system and based on specified fiscal intervention scenarios. These simulations were operationalized using a model based on the World Health’s Tobacco Tax Simulation Model (TaXSiM)...see more.

Reducing Tobacco Use through Taxation in Trinidad and Tobago: Modelling the Long-term Economic Impact

This Study built on the results of the “Assessment of Tobacco Taxation in Trinidad and Tobago” Project. Specifically, the results of the two taxation scenarios formed the basis of the analysis carried out in this project. The Report produced from this Study: Reducing Tobacco use through Taxation in Trinidad and Tobago: Modelling the Long-term Economic Impact. 2018, the World Bank Group...see more.

Harmonization of Tobacco Taxation in the Organization of Eastern Caribbean States (OECS)

Confronting Illicit Tobacco Trade: A Global Review of Country Experiences

This Study investigated the measures utilised to address the illicit tobacco trade in the Caribbean region. The study focused on the member countries of the OECS and Trinidad and Tobago. Chapter Produced from this study: “Chapter 8: Organisation of Eastern Caribbean States (OECS) and Trinidad and Tobago Caribbean Regional Report on Illicit Tobacco Trade.” In Confronting Tobacco Illicit Trade: A Global Review of Country Experiences, edited by Sheila Dutta, 227-253... see more.

“Financing NCD Prevention and Control in CARICOM - Potential Roles of Tobacco and Alcohol Taxes” in The Evaluation of the 2007 CARICOM Heads of Government Port of Spain NCD Summit Declaration

The HEU held responsibility for executing Objective 4b: Estimating the Potential for Revenue Generation for NCD Prevention and Control from Taxes on Tobacco and Alcohol. In this portion of the study, data were collected and analysed with the aim of estimating the potential that exists within CARICOM for using tobacco and alcohol taxes to raise revenues to fund NCDs prevention and control efforts. The analysis was conducted using the TaXSiM...see more.

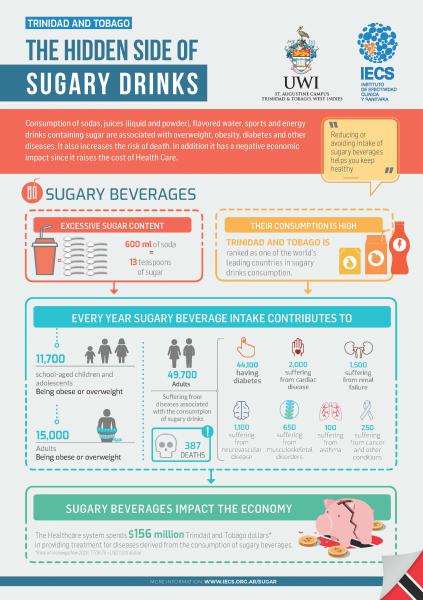

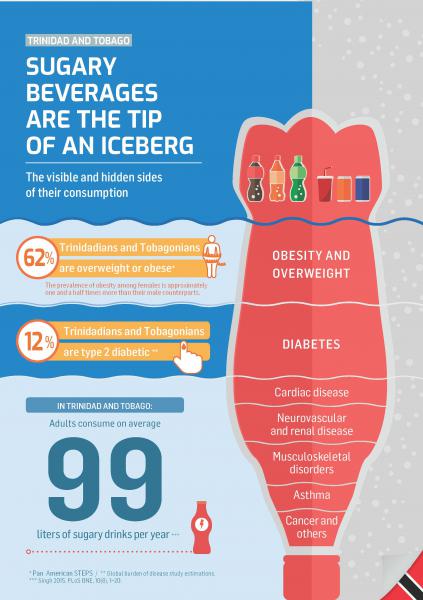

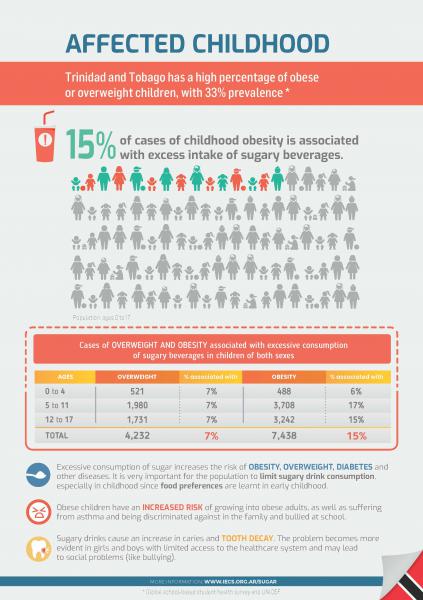

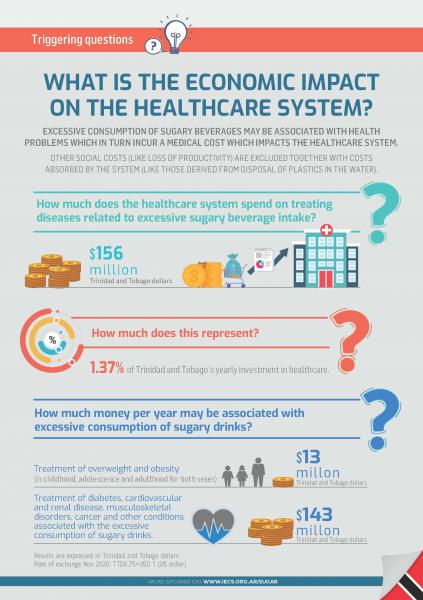

Sugar Sweetened Beverages

Empowering Healthcare Decision Makers to Achieve Regional Needs in Sugar-Sweetened Beverage [SSB] Policies in Latin America and the Caribbean

The overall objective of this Study is to empower decision makers to implement policies to reduce SSB consumption through the provision of an evidence base for decision-making. The study seeks to (i) map interventions associated with SSB; (ii) provide information on the burden of disease potentially attributable to SSBs (both the health and economic impact) and (iii) estimate the potential impact and cost-effectiveness of different strategies for the control of the SSB consumption, which are being implemented or considered in the region.

- FISCAL POLICIES FOR REDUCING SUGAR SWEETENED BEVERAGES CONSUMPTION

- FRONT-OF-PACKAGE LABELING FOR REDUCING SUGAR-SWEETENED BEVERAGE CONSUMPTION

- EDUCATIONAL ACTIONS AND MODIFICATION OF SCHOOL ENVIRONMENT TO DECREASE SUGAR SWEETENED BEVERAGE CONSUMPTION

- SUGAR-SWEETENED BEVERAGES ADVERTISING,PROMOTION, AND SPONSORSHIP BAN

For more information and details on this study, please visit: https://www.iecs.org.ar/en/sugar-trinidad-tobago/#tab-1-5